DUBAI EXPO 2020: “CONNECTING MINDS, CREATING THE FUTURE

An Expo is a world fair or an extravagant international exhibition designed to showcase achievements of nations. The word Expo was derived from the French word “Exposition Universelle” which means Universal Exposition. There are two types of Expos that are conducted in different parts of the world; one being World Expo (formally known as International Registered Exhibitions) and other being Specialized Expo (formally known as International Recognised Exhibitions). Since the 1928 Convention Relating to International Exhibitions came into force, the Bureau International des Expositions (BIE) has served as an international sanctioning body for international exhibitions. As per the norms, a bidding process began in 2011 between four different Countries and Dubai was declared the winner. This triumph and jubilation led to the massive event called Dubai Expo 2020.

Theme of Expo 2020:

Expo 2020, is the First World Expo that is being conducted in the Middle East, Africa and South Asia (MEASA) region;

1. starting from October 20, 2020 to April 10, 2021. The event which is hosted in the heart of Dubai shall welcome 200 international countries and about 25 million or more visitors. It will be one big step towards efficient development.

2. The Expo will be held in the name of ‘Connecting Minds, Creating the Future.’ The goal is to connect people and innovative ideas, leading the people of the world towards a better tomorrow.

3. Opportunity, Mobility and Sustainability shall be the core themes of the Expo and it will connect nations, multinational corporations, non-government organisations and millions of visitors from all over the world, providing an opportunity to see future innovations, marvel at unique architecture, experience diverse cultures, taste cuisines from all over the world, and enjoy live performances, art and other entertainment.

Initiatives in the Expo 2020:

1. Al Wasl Plaza is one of the biggest initiatives taken in the Expo and it is said to bring together a physical manifestation of the main theme of the Expo; it is the site where the event will be conducted and each participating country will have its own pavilion to showcase their achievements and innovations.

2. World Majlis is a dialogue programme aimed at facilitating global conversation and creating connection between people and ideas. It brings together various government, professional, academics and cultural backgrounds in a meetings space where people will share informed opinions to help shape decision for communities.

3. Expo Live is an innovation and partnership programme launched by Expo 2020 to promote creative solutions that improve

lives while preserving the planet. Expo Live will support to demonstrate the power of a World expo in bringing a progressive and a prosperous future.

4. Global Best Practice Programme is a series of best practices from around the world have been selected to be showcased in the event. A total of 25 Best practices in five different categories have been selected by an international jury that can be replicated, adapted and scaled for a greater global impact.

Interesting facts on the Expo 2020

- Expo 2020 Dubai will have a dedicated metro station capable of carrying 23,000 passengers per hour in each direction.

Dubai’s metro system is driverless. - The Expo site is 4.38sq km in size, or 613.5 football pitches if you prefer.

- There will be a ‘Superstore of the Future’ on site which will be 3,000sqm in size.

- 25 million visitors are expected to visit Expo 2020 Dubai, Australia’s population is a similar number.

- Expo is expected to create almost 300,000 jobs. The majority in the tourism sector.

- 90% of the materials used to construct the site will be used to create legacy buildings after the event.

- Uber has signed an agreement with Dubai’s Roads and Transport Authority to test flying cars during the event.

- The Expo 2020 Dubai logo was inspired by a ring found in the UAE at 4000-year-old archaeological site.

EXPO 2020: A massive phenomenon for the Country and the people

Each new beginning, every new initiative, any new product brings a lot of changes and development in the society and and the Expo is no different, it also aims in bringing the best for the people and the residents of UAE.

- According to Expo 2020 Executive Body, Dubai’s Expo 2020 is expected to yield $24.2 billion in revenue;

- Expo 2020 will provide 277,000 new job opportunities and will have a positive impact on small and medium enterprises

(SMEs); - It is predicted to boost the economy of the Emirates by an average of 6.4 percent every year from 2014 to 2016 – ultimately increasing to 10.5 percent by 2020;

- The UAE government has predicted that revenues of up to $17.7 billion will be generated if the Expo is a success, which organizers feel is certain;

- Some analysts have predicted that by 2020, the UAE could garner as much as $150 billion in foreign direct investment in sectors such as real estate, hospitality, and tourism;

- The Expo 2020 is expecting 25 million visitors, 17 million of which will be international, this naturally will give a big thrust to the tourism and hospitality industries;

- For the Expo, Dubai is constructing a massive new city over an area of 1,082-acre. This project itself has generated 15% of the city’s new jobs. The figure is expected to double as the city gets closer to 2020.

Conclusion:

Thus Expo 2020 Dubai will be a celebration of human brilliance and achievement and an opportunity for people to connect from different corners of the world, to experience the best of art, culture, geography, science, technology, innovation and invention and to set into motion millions of new thoughts and ideas that will make a lasting impact in our lives.

Throughout its history, UAE has shown the world what is possible through its remarkable development. With Expo 2020 Dubai, Dubai will go a step further in inspiring the next generation to spark innovations that will underline the next 50 years of human progress.

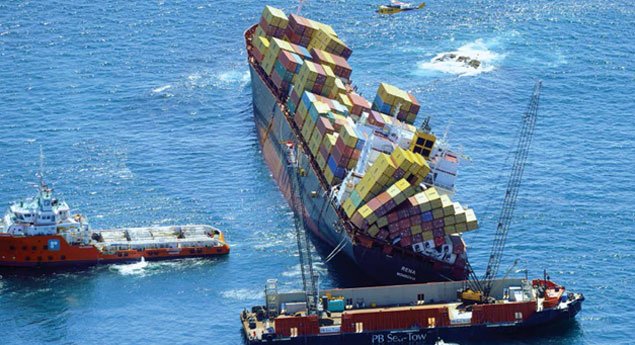

Rennell Island, one of the country’s outlying islands in its southern Rennell and Bellona Province, is geographically remote with little infrastructure and few services. The Solomon Islands is part of the marine biodiversity-rich Coral Triangle and has one of the world’s most important coral reef systems, home to 485 coral species and 1,019 fish species.

Rennell Island, one of the country’s outlying islands in its southern Rennell and Bellona Province, is geographically remote with little infrastructure and few services. The Solomon Islands is part of the marine biodiversity-rich Coral Triangle and has one of the world’s most important coral reef systems, home to 485 coral species and 1,019 fish species.

Digitalization has brought in many challenges as well as opportunities. According to the IMO over 90% of the world’s trade is carried out by sea as this is the most cost-effective way to move goods and raw materials across the world. One of the important factors is that it reduces cost and increases efficiency. The data inputs and interconnected technologies are emerging to create a revolution in the maritime industry. Systems like Radio Frequency Identification System (RFID) are used to track the movement of the vehicles cargo and people, and ensure timely delivery of cargo. GPS navigation system, automated electronic data exchange from ship to ship and ship to shore increases the efficiency, safety and accuracy in navigation and communications.

Digitalization has brought in many challenges as well as opportunities. According to the IMO over 90% of the world’s trade is carried out by sea as this is the most cost-effective way to move goods and raw materials across the world. One of the important factors is that it reduces cost and increases efficiency. The data inputs and interconnected technologies are emerging to create a revolution in the maritime industry. Systems like Radio Frequency Identification System (RFID) are used to track the movement of the vehicles cargo and people, and ensure timely delivery of cargo. GPS navigation system, automated electronic data exchange from ship to ship and ship to shore increases the efficiency, safety and accuracy in navigation and communications. Arbitration is an alternative dispute resolution process, in which the parties to a contract, present the arguments and evidence to an independent and neutral third party known as the “arbitrator” who is appointed by mutual consent or a statutory provision. This arbitrator who acts as a judge makes a determination named as an “award” which is legally enforceable and binding on both the parties.

Arbitration is an alternative dispute resolution process, in which the parties to a contract, present the arguments and evidence to an independent and neutral third party known as the “arbitrator” who is appointed by mutual consent or a statutory provision. This arbitrator who acts as a judge makes a determination named as an “award” which is legally enforceable and binding on both the parties. International Maritime Organization’s ship pollution rules are contained in the “International Convention on the Prevention of Pollution from Ships”, known as MARPOL 73/78. On 27 September 1997, the MARPOL Convention has been amended by the “1997 Protocol” which includes Annex VI titled “Regulations for the Prevention of Air Pollution from Ships”. MARPOL Annex VI sets limits on NOx and SOx emissions from ship exhausts and prohibits deliberate emissions of ozone depleting substances.

International Maritime Organization’s ship pollution rules are contained in the “International Convention on the Prevention of Pollution from Ships”, known as MARPOL 73/78. On 27 September 1997, the MARPOL Convention has been amended by the “1997 Protocol” which includes Annex VI titled “Regulations for the Prevention of Air Pollution from Ships”. MARPOL Annex VI sets limits on NOx and SOx emissions from ship exhausts and prohibits deliberate emissions of ozone depleting substances.

On 12 December, 2016 a Memorandum of Understanding was signed between the Dubai International Financial Centre (hereinafter referred as “DIFC”) and Ras Al Khaimah (hereinafter referred to as “RAK”) Free Trade Zone Authority, RAK Investment Authority and RAK International Corporate Centre to enhance the efficient enforcement of the Judgment and / or Orders pronounced by the DIFC Courts.

On 12 December, 2016 a Memorandum of Understanding was signed between the Dubai International Financial Centre (hereinafter referred as “DIFC”) and Ras Al Khaimah (hereinafter referred to as “RAK”) Free Trade Zone Authority, RAK Investment Authority and RAK International Corporate Centre to enhance the efficient enforcement of the Judgment and / or Orders pronounced by the DIFC Courts. In the recent Appeal filed by M/s Hindustan Copper Limited against M/s Centrotrade Minerals and Metals Inc., the Honourable Three Judge Bench of the Supreme Court of India held that “the Arbitration Clause in the Agreement between the parties does not violate the fundamental or public policy of India by the parties agreeing to the Second Instance Arbitration”.

In the recent Appeal filed by M/s Hindustan Copper Limited against M/s Centrotrade Minerals and Metals Inc., the Honourable Three Judge Bench of the Supreme Court of India held that “the Arbitration Clause in the Agreement between the parties does not violate the fundamental or public policy of India by the parties agreeing to the Second Instance Arbitration”.